Running a successful dental practice isn't just about excellent clinical skills. Behind every thriving practice is solid financial management. Dentists who partner with accountants who understand the unique challenges of dental businesses simply do better—they keep more of what they earn, make smarter investments, and build more valuable practices.

When regular accountants handle dental finances, they often miss opportunities that specialists catch immediately. From maximizing tax deductions on equipment to properly tracking production metrics, dental-specific financial expertise directly impacts your bottom line.

Let's explore how finding the right financial partner can transform your practice's profitability and reduce your stress along the way.

What Makes a Great Dental Accountant?

The best financial professionals for dental practices understand both numbers and the day-to-day realities of running a dental office. Look for these qualities:

- Deep dental knowledge: They understand production metrics, insurance billing cycles, and dental terminology.

- Practice management insight: They know how clinical decisions affect financial outcomes.

- Software familiarity: They've worked with systems like Dentrix, Eaglesoft, or Open Dental.

- Insurance expertise: They understand the complex world of dental insurance reimbursements.

- Tax specialization: They know which deductions dental practices can legitimately claim.

- Transition experience: They can guide practice sales, partnerships, and retirement planning.

- Associate compensation understanding: They can structure profitable arrangements with associates.

- Multi-location skills: They can manage finances across several practice locations.

Services That Make a Difference

Dental accounting specialists do much more than basic bookkeeping. Their comprehensive services typically include:

Financial Management

- Setting up dental-specific accounting systems.

- Preparing monthly financial statements you can actually understand.

- Tracking production and collection rates.

- Managing insurance aging reports.

- Analyzing overhead compared to industry standards.

- Evaluating fee schedules for profitability.

- Forecasting cash flow.

- Tracking dental supply expenses.

- Analyzing lab fees and procedure profitability.

Tax Strategy and Compliance

- Preparing dental practice tax returns.

- Planning tax strategies for your specific business structure.

- Optimizing equipment depreciation.

- Developing retirement plan tax strategies.

- Planning for practice real estate.

- Maximizing legitimate deductions.

- Calculating quarterly estimated taxes.

- Ensuring product sales tax compliance.

Practice Growth and Planning

- Assessing practice value and financial health.

- Structuring associate buy-ins.

- Financial planning for new practices.

- Analyzing practice acquisitions.

- Evaluating DSO affiliation opportunities.

- Planning practice expansions.

- Improving profitability.

- Analyzing new technology investments.

- Planning practice transitions.

The Real Value of Dental Financial Expertise

Dental practices face unique challenges that general accountants often miss. Here's why specialized expertise matters:

- Better profits: Dental accountants know the right overhead targets for practices like yours.

- Meaningful benchmarks: They compare your performance to similar practices, not general businesses.

- Production insights: They track metrics that matter in dentistry—chair time, hygiene production, case acceptance.

- Insurance optimization: They analyze which plans actually benefit your practice.

- Smarter tax strategies: They know legitimate deductions specific to dental practices.

- Practice value growth: They implement strategies that make your practice worth more when it's time to sell.

- Compliance confidence: They keep you meeting all dental industry financial requirements.

- Strategic guidance: They provide informed advice on major decisions like equipment purchases or expansion.

Bookkeeping vs. Accounting: What's the Difference?

Most dental practices need both bookkeeping and accounting services:

What Dental Bookkeepers Do

- Record daily production and collections.

- Process payroll for your team.

- Pay bills for supplies and services.

- Reconcile bank statements.

- Track patient refunds and insurance adjustments.

- Maintain expense records.

- Process vendor payments.

- Generate basic financial reports.

Bookkeepers handle essential daily tasks with attention to dental-specific categories, creating the foundation for good financial management.

What Dental Accountants Add

- Analyze practice profitability metrics.

- Develop tax strategies that save thousands.

- Guide major practice decisions.

- Evaluate your fee structure.

- Plan practice transitions or expansions.

- Structure associate compensation.

- Implement retirement planning.

- Create long-term financial growth plans.

Most practices benefit from both services—either from one provider or through a combination of in-house bookkeeping and external accounting expertise.

Dental Accounting in 2025: Current Market Trends

The demand for dental accounting specialists continues to grow as practices face:

- Changing insurance reimbursement models.

- Increasing practice consolidation.

- Complex ownership structures.

- Rising costs affecting profitability.

- Technology investments requiring ROI analysis.

- Complicated tax planning needs.

Different Practice Types Have Specific Accounting Needs

- Solo practices: Need accountants who can maximize profitability while managing all aspects of finances.

- Group practices: Require experts in production tracking and partner compensation.

- Specialty practices: Need accountants familiar with their unique procedure mix and revenue patterns.

- DSO-affiliated practices: Need accountants who understand both practice and corporate reporting.

- New practices: Require help establishing financial systems and guiding growth.

- Practices in transition: Need expertise in valuation and transition planning.

What Should You Pay for Dental Financial Services?

Costs vary based on practice size, service scope, and location. Here's what to expect:

Bookkeeping Costs

- Basic dental bookkeeping: $500-1,000 monthly.

- Comprehensive bookkeeping: $1,000-2,000 monthly.

- Part-time in-house bookkeeper: $25-40 hourly.

Accounting Costs

- Monthly accounting services: $1,500-3,000.

- Quarterly financial review: $750-1,500.

- Annual tax preparation: $2,500-5,000+.

- Comprehensive packages: $2,500-5,000 monthly.

Specialized projects like practice transitions or valuations typically cost $3,000 to $10,000+ depending on complexity.

Is Specialized Dental Accounting Worth the Cost?

Dental accounting specialists charge more than general accountants, but the return on investment is clear:

- Profit improvement: Dental accountants typically improve margins by 3-5%.

- Tax savings: Their specialized knowledge saves $10,000-50,000+ annually.

- Revenue growth: Their production analysis often increases revenue by 10-15%.

- Better decisions: Their industry-specific advice prevents costly mistakes.

- Practice value: Their strategies typically increase practice valuation by 20-30% over five years.

Most practices recoup the additional cost through tax savings alone, with profitability improvements providing additional benefits.

Finding Your Ideal Dental Accountant

Finding the right accounting professional involves these steps:

- Assess their dental industry experience.

- Verify dental credentials and specialized training.

- Confirm they know your practice management software.

- Evaluate their dental client base.

- Clarify which services you need.

- Review their communication style.

- Understand their fee structure.

- Check references from other dental practices.

- Decide between local or virtual services.

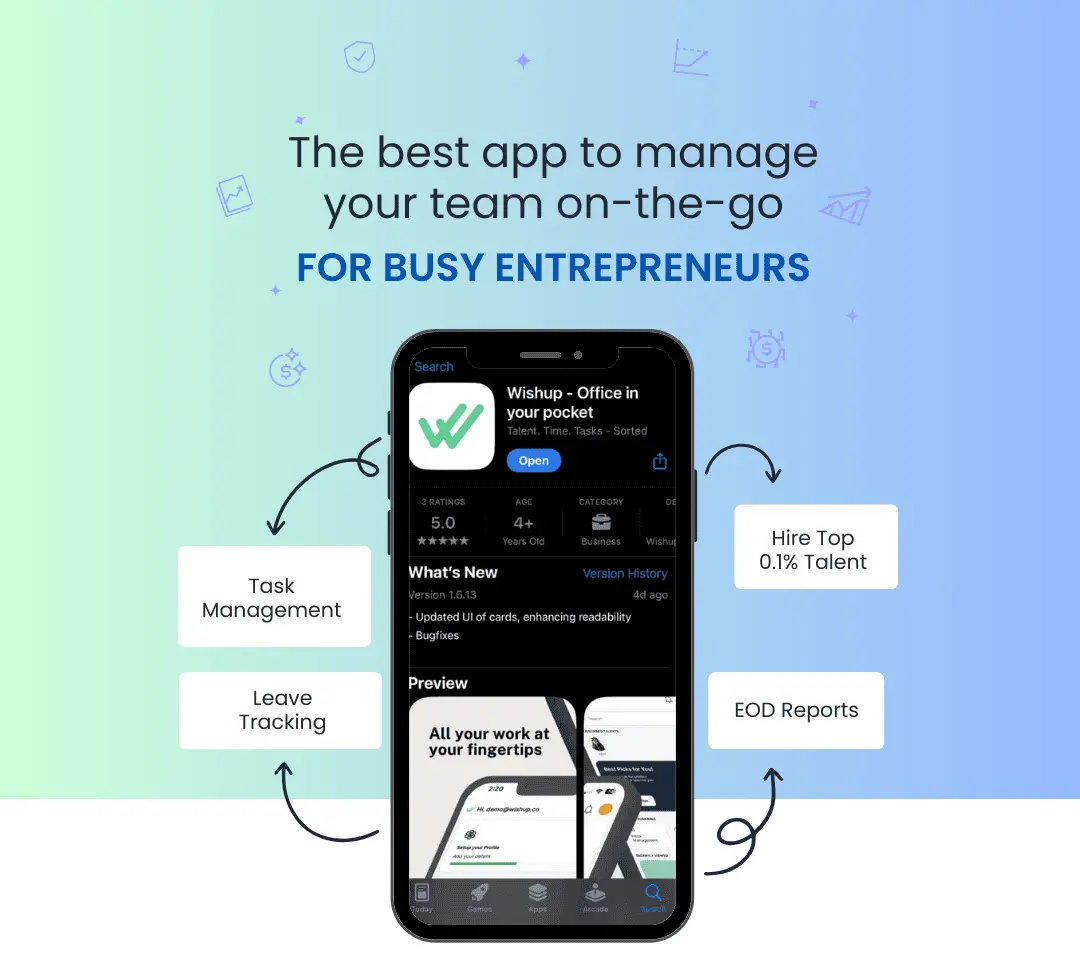

- Consider Wishup's specialized dental accounting solutions.