Our Comprehensive Suite of Services

Key Tasks Managed by Your Virtual Financial Assistant

Client Relationship Management

Our VA keeps client interactions smooth by handling follow-ups, scheduling review calls, and ensuring no inquiry goes unanswered.

Financial Data Handling

From organizing transaction records to analyzing data and updating books, our financial advisor VAs handle everything with accuracy and speed.

Market Research

They track market trends, product updates, and investment opportunities, giving you insights that help you advise smarter.

Performance Reporting

Your personal financial assistant pulls performance data, builds reports, and prepares client presentations.

Compliance Management

Our VAs ensure compliance with financial regulations and standards, maintaining integrity and avoiding business risk.

Digital File Organization

They manage and organize your digital files systematically for quick access, secure storage, and improved overall workflow efficiency.

Choose the Best

Why Wishup's Financial Planner Virtual Assistants?

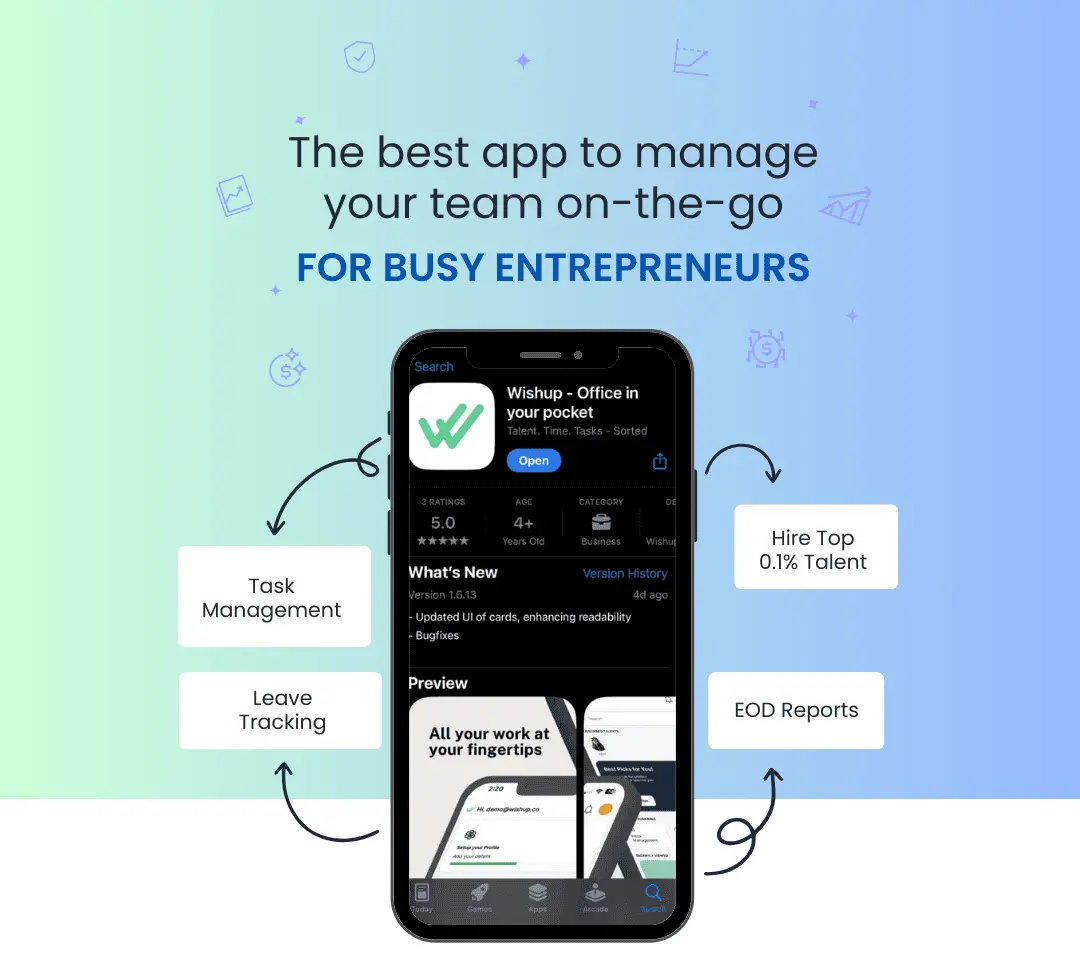

Top Talent

Select from the top 0.1% of candidates, ensuring unmatched professional quality.

Instant Onboarding

Get an expert in a jiffy with our 60-minute onboarding process.

Flexible Hiring Options

Full-time or part-time, we customize according to your requirements.

What Changed After They Hired Virtual Assistants

▶

▶Took the Leap, Gained Their Time Back

Hiring Can't Get Any Easier

Our 3-step easy hiring process

Discuss your requirements with us

Manage Your Workforce Easily

Provide real-time feedback, manage projects, hire top-tier talent and get EOD reports—all from one app. Download the App Now!