Legal practices face unique financial management challenges. Between trust accounting requirements, complex billing structures, and strict compliance needs, law firm bookkeeping demands specialized expertise that goes well beyond general bookkeeping knowledge.

This breakdown covers what legal bookkeepers do, what they typically cost in 2025, and how to find the right financial partner for your firm's specific needs.

Why Law Firms Need Specialized Bookkeeping

Standard bookkeeping approaches often fail in legal settings due to several industry-specific factors:

- Trust account management – Commingling client funds with operating accounts can lead to disbarment

- IOLTA compliance – Interest on Lawyers Trust Accounts requires precise tracking and reporting

- Matter-based billing – Expenses and time must link accurately to specific client matters

- Contingency fee structures – These require specialized expense tracking and revenue recognition

- Ethical billing requirements – Legal fees must be reasonable and properly documented

- Multiple timekeepers – Partners, associates, and paralegals bill at different rates

- Complex disbursements – Client costs must be tracked separately from firm expenses

Essential Services a Legal Bookkeeper Provides

A specialized law firm bookkeeper or legal accountant delivers critical services tailored to legal practice needs:

Trust Account Management

- Separate tracking of each client's retainer funds

- Three-way reconciliation (book balance, bank balance, client ledger)

- IOLTA compliance documentation

- Prevention of unintentional fund commingling

- Clear audit trails for bar association review

Matter-Based Accounting

- Expense allocation to specific cases

- Profitability tracking by matter type

- Budget management for individual cases

- Client cost recovery management

- Comprehensive case financial reporting

Revenue Management

- Proper handling of unearned vs. earned fees

- Contingency fee tracking and recognition

- Alternative fee arrangement accounting

- Billing realization rate analysis

- Collections management and aging reports

Compliance Support

- Bar association requirement adherence

- Tax reporting and preparation

- Annual filing assistance

- Financial documentation for audits

- Regulatory change implementation

Performance Analysis

- Partner compensation calculations

- Practice area profitability assessment

- Timekeeper performance metrics

- Expense trend identification

- Benchmark comparisons within legal industry

The Real Cost of Legal Bookkeeping Services in 2025

Investing in specialized law firm bookkeeping services involves these typical costs:

Hourly Rate Models

| Service Level |

Entry-Level |

Mid-Range |

Expert |

| Basic Legal Bookkeeping |

$30-45/hr |

$45-65/hr |

$65-95/hr |

| Trust Account Specialist |

$45-65/hr |

$65-85/hr |

$85-125/hr |

| Full-Service Legal Accounting |

$60-85/hr |

$85-125/hr |

$125-175/hr |

| Controller-Level Services |

$85-125/hr |

$125-175/hr |

$175-250/hr |

Cost-Influencing Factors

Several variables affect legal bookkeeping pricing:

- Number of timekeepers – More billing attorneys increase complexity

- Practice areas – Certain specialties (PI, class action) require more intensive tracking

- Trust account volume – High client fund throughput requires additional oversight

- Billing frequency – Weekly or bi-weekly billing cycles cost more than monthly

- Software platform – Specialized legal software expertise commands premium rates

- Financial state – Cleanup of problematic books costs more initially

- Service scope – Full-service (including AP/AR, payroll) vs. basic bookkeeping

In-House vs. Outsourced Legal Bookkeeping: Cost Comparison

| Expense Category |

In-House Legal Bookkeeper |

Outsourced Legal Bookkeeper |

Annual Savings |

| Salary/Service Fees |

$60,000–85,000 |

$18,000–30,000 |

$30,000–67,000 |

| Benefits & Taxes |

$12,000–17,000 |

$0 |

$12,000–17,000 |

| Legal Software |

$3,000–9,000 |

Often included |

$3,000–9,000 |

| Continuing Education |

$1,500–3,000 |

$0 |

$1,500–3,000 |

| Office Space/Equipment |

$6,000–12,000 |

$0 |

$6,000–12,000 |

| Partner Oversight Time |

$15,000–25,000 |

$5,000–10,000 |

$10,000–15,000 |

| TOTAL ANNUAL COST |

$97,500–151,000 |

$23,000–40,000 |

$62,500–123,000 |

The average law firm saves 65-75% by outsourcing legal bookkeeping compared to hiring in-house staff.

Warning Signs Your Law Firm Needs Better Bookkeeping

Your firm may need specialized legal bookkeeping help if you notice:

- Trust account reconciliations taking more than 3-4 hours monthly

- Difficulty producing three-way trust reconciliations for bar compliance

- Challenges tracking which expenses belong to which matters

- Partners spending 5+ hours weekly on financial oversight

- Inconsistent profitability across similar case types

- Limited visibility into timekeeper productivity and realization

- Anxiety about potential Bar Association financial audits

- Billing delays due to incomplete expense or time tracking

- Cash flow constraints despite strong case revenue

- Multiple accounting software systems that don't communicate

How to Select the Right Legal Bookkeeper

Finding the perfect match for your firm involves evaluating several crucial factors:

Legal Industry Experience

Look for professionals with:

- Specific legal bookkeeping training and certification

- Experience with firms similar to yours in size and practice areas

- Understanding of attorney-client privilege implications for financial data

- Familiarity with your state's specific bar requirements

- Background working with other firms in your practice areas

Technical Expertise

Ensure they have proficiency in:

- Legal-specific software (Clio, Practice Panther, Rocket Matter, PCLaw, etc.)

- Trust accounting and three-way reconciliation procedures

- Matter-based accounting methodologies

- Conflict-checking systems integration

- Time and billing software used by your firm

Compliance Knowledge

Verify their understanding of:

- IOLTA and trust accounting rules in your jurisdiction

- Ethics opinions related to legal billing in your state

- Financial documentation requirements for your practice areas

- Record retention policies for legal financial data

- Current and upcoming regulatory changes affecting law firm accounting

Service Scope

Confirm they can handle your specific needs:

- Trust account management and compliance

- Matter cost allocation and tracking

- Revenue recognition for your fee structures

- Partner compensation calculations

- Client cost advanced management

- Financial reporting customized for legal practices

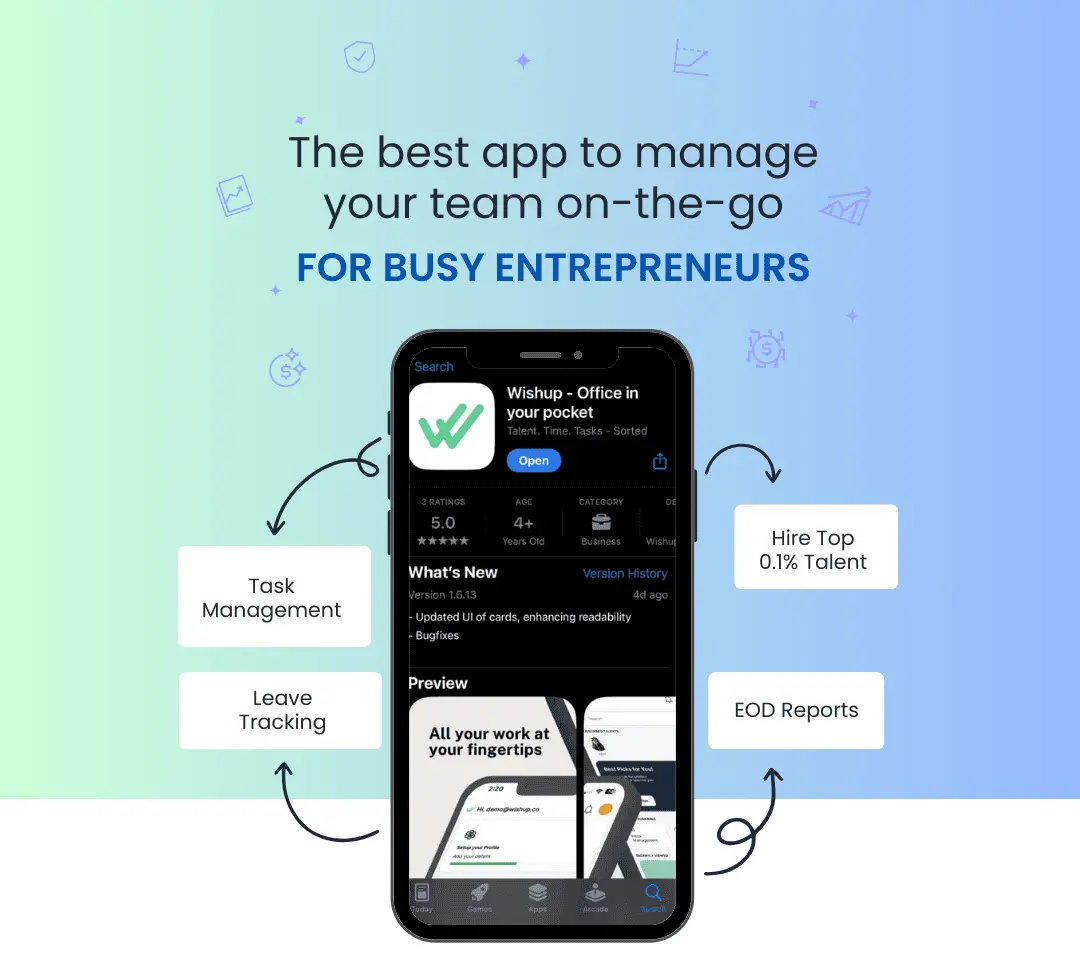

6 Unique Benefits of Hiring Legal Bookkeepers from Wishup

- Ethical wall protection – Our legal bookkeepers implement digital and procedural safeguards that prevent financial data leaks between matters with potential conflicts.

- Matter profitability forecasting – Wishup's legal financial specialists provide predictive analytics that forecast final profitability for active matters based on current trajectories.

- Dual-certified expertise – Every Wishup legal bookkeeper holds both accounting certification and specialized legal industry training, ensuring both technical accuracy and compliance.

- Automated bar compliance – Our proprietary compliance calendar system tracks changing requirements across all 50 state bar associations, eliminating surprise deadline issues.

- Collection rate enhancement – Firms using Wishup's legal bookkeeping services see an average 31% improvement in collection rates through our specialized billing optimization process.

- Partner-ready presentations – Unlike standard bookkeepers, Wishup provides monthly financial insights in concise, visual formats specifically designed for law partner meetings.