Running a business is hard enough without drowning in receipts and invoices every month. If you're like most business owners, bookkeeping probably isn't your favorite part of the job. Maybe you're staying up late trying to reconcile accounts, or perhaps that shoebox full of receipts is giving you anxiety every time you look at it.

Here's the good news - you don't have to do it all yourself anymore. Virtual bookkeepers are changing the game for businesses of all sizes, and they're more accessible than you might think.

What Does a Virtual Bookkeeper Actually Do?

Think of a virtual bookkeeper as your financial right-hand person - just without taking up space in your office. They're the professionals who make sure every dollar is tracked, every invoice is paid, and your books are always clean and organized.

Most business owners we talk to are surprised by just how much a virtual bookkeeper can handle. Beyond just data entry, they're trained professionals who understand the ins and outs of business finances. They can spot patterns in your spending, flag potential issues before they become problems, and help you understand exactly where your money is going.

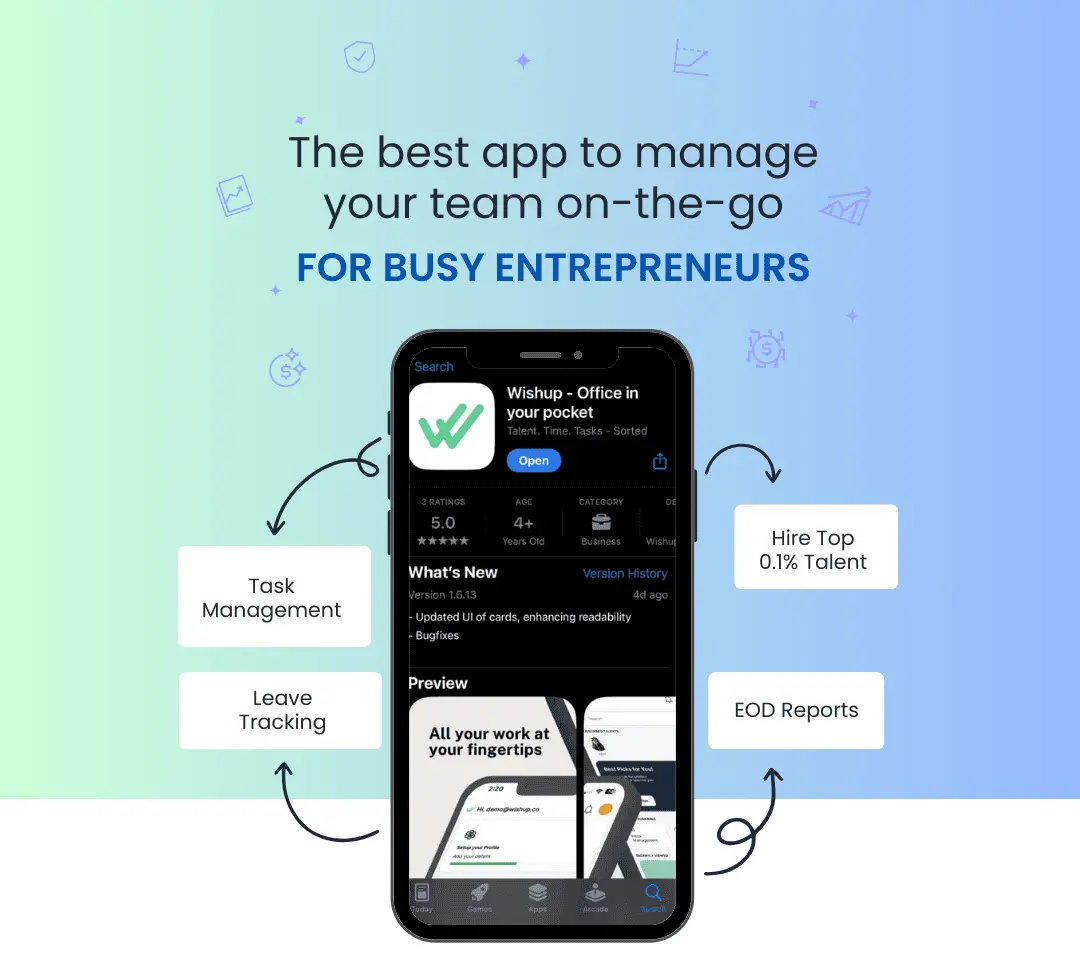

Here are 90+ tasks that a Wishup Bookkeeper can do for you:

Real Talk: How Much Does This Cost?

Let's address the elephant in the room - cost. Nobody likes surprises when it comes to pricing, so here's the straight story:

Virtual bookkeeping is typically more affordable than you'd expect, especially when compared to hiring an in-house bookkeeper. While rates can vary based on your needs, here's what you can generally expect:

Starting services might run you $25-35 per hour - perfect if you just need basic transaction tracking and monthly reconciliation. More comprehensive services usually fall between $35-55 per hour, while complex bookkeeping (think multiple entities or specialized industries) might go up to $55-100 per hour.

At Wishup, you get a pre-trained, experienced bookkeeper starting from $9.99/hour.

Know more about Wishup pricing

But here's what really matters: you're not just paying for someone to input numbers. You're investing in:

- Peace of mind knowing your finances are in order

- Professional insights to help you make better financial decisions

- Protection against costly mistakes and oversights

Is a Bookkeeper Really Cheaper Than an Accountant?

This is a question we hear all the time, and the short answer is yes - but it's not just about the cost. Think of it this way: a bookkeeper is like having a daily fitness routine, while an accountant is more like visiting a specialist for specific health concerns. Both are valuable, but they serve different purposes.

Bookkeepers typically charge 30-50% less than accountants because they focus on different aspects of your financial health. While your bookkeeper handles the crucial day-to-day tracking and organization, an accountant steps in for specialized services like tax strategy or financial planning.

Finding the Right Virtual Bookkeeper

Every business is unique, and finding the right fit is crucial. After helping thousands of businesses with their bookkeeping needs, we've learned what truly matters isn't just technical skills - it's finding someone who gets your business.

Consider this: You wouldn't hand your house keys to just anyone, right? The same goes for your business finances. The right virtual bookkeeper becomes a trusted partner who helps your business thrive. They should understand your industry, speak your language, and make your life easier - not more complicated.

When Do You Know It's Time to Get Help?

You might be wondering if you really need a virtual bookkeeper. Here are some tell-tale signs we've seen from business owners who made the switch:

- Your Sunday evenings are spent catching up on bookkeeping instead of being with family.

- You're not sure if your business is as profitable as it could be.

- QuickBooks has become your nemesis rather than a helpful tool.

- You've had a few too many "surprises" when checking your bank balance.

Common Questions We Hear Every Day

"Will I lose control of my finances if I hire a virtual bookkeeper?" Not at all. Think of it like hiring a professional landscaper - they maintain your yard, but you still own the property. You'll have full access to your books and final say in all decisions. Many business owners find they actually feel more in control because they finally have clear visibility into their finances.

"How do I know my information is secure?" Security is a top priority. Professional virtual bookkeeping services use bank-level encryption and secure systems to protect your data. They should be happy to explain their security measures in detail - if they're not, that's a red flag.

"What if my business is too small?" Here's the truth: if you're making money, you need some form of bookkeeping. Starting with professional help early can prevent major headaches down the road. It's often the smallest businesses that benefit most from having organized finances.

Tools That Actually Make a Difference

Most virtual bookkeepers rely on a core set of tools to keep your finances organized. But here's what really matters - not the fancy features, but the practical benefits these tools bring to your business.

Essential Software That's Worth Your Time

- QuickBooks Online leads the pack for a reason. It's not just about tracking numbers - it gives you a clear picture of your cash flow and helps spot trends in your business. Plus, most bookkeepers know it inside and out, which means fewer headaches during setup.

- Xero is another solid choice, especially if you're running an international business. It handles multiple currencies smoothly and plays nice with tons of other business tools you might be using.

Document Management That Makes Sense

Remember that shoebox of receipts we talked about? Tools like Receipt Bank or Hubdoc can turn that chaos into organized digital records. Just snap a photo of your receipt, and it's stored safely in the cloud. No more lost receipts or last-minute scrambles at tax time.

Industries That Need Virtual Bookkeepers Most

Every business needs bookkeeping, but some industries particularly benefit from virtual support:

E-commerce Businesses: With constant transactions, inventory tracking, and multiple sales channels, online stores need dedicated financial oversight. Virtual bookkeepers help manage platform fees, payment processor reconciliation, and inventory costs.

Professional Services & Consulting: Law firms, marketing agencies, and consultants need help tracking billable hours, managing retainers, and handling client invoicing. A virtual bookkeeper ensures nothing falls through the cracks.

Real Estate & Property Management: Managing rental income, maintenance expenses, and property-related costs requires consistent attention. Virtual bookkeepers help track property-specific expenses and maintain clear records for tax purposes.

Healthcare Practices: Medical offices deal with complex insurance billing, patient payments, and strict compliance requirements. Virtual bookkeepers with healthcare experience can navigate these unique challenges.

How to Hire a Top Virtual Bookkeeper

Finding the right virtual bookkeeper requires a clear process:

- Define Your Needs: Start by documenting:

- Transaction volume

- Software preferences

- Industry-specific requirements

- Reporting needs

- Budget constraints

- Verify Qualifications: Look for:

- Relevant certifications (QuickBooks ProAdvisor, CPB)

- Experience in your industry

- Technology proficiency

- Communication skills

- Problem-solving abilities

- Test Their Knowledge: Ask about:

- Their approach to common challenges

- Experience with your specific needs

- Communication style and availability

- Backup procedures

- Security protocols

- Check References: Verify:

- Past client experiences

- Reliability and responsiveness

- Problem-solving abilities

- Industry expertise

- Communication style

Virtual Bookkeeper Job Description Template

About Us

[Your Company Name] is seeking an experienced Virtual Bookkeeper to join our team. We're a [brief company description] looking for someone who can maintain our financial records with precision while helping us make data-driven business decisions.

Position Overview

We're looking for a detail-oriented Virtual Bookkeeper to manage our day-to-day financial operations remotely. The ideal candidate will have strong experience with QuickBooks Online and excellence in maintaining accurate financial records.

Core Responsibilities

- Manage daily bookkeeping operations including AR/AP

- Reconcile bank and credit card accounts monthly

- Process payroll and ensure tax compliance

- Create and review financial statements

- Handle monthly account closings

- Maintain organized digital records

- Generate regular financial reports

- Track and categorize expenses

- Assist with tax preparation

- Manage vendor relationships and payments

Required Qualifications

- 3+ years of bookkeeping experience

- Advanced proficiency in QuickBooks Online

- Strong knowledge of accounting principles

- Experience with payroll processing

- Excellent attention to detail

- Strong communication skills

- Ability to work independently

- High level of discretion with confidential information

Technical Skills

- QuickBooks Online (required)

- Microsoft Excel (advanced level)

- Payroll software experience

- Digital documentation systems

- Cloud-based collaboration tools

Preferred Qualifications

- Certified Bookkeeper (CB) certification

- Experience in [your industry]

- Knowledge of [specific software you use]

- Previous remote work experience

- Familiarity with [specific workflows/processes]

Work Schedule

[Full-time/Part-time] position

Remote work with flexible hours

Core availability during [time zone] business hours

Monthly financial close schedule

Benefits (For Full-Time Positions)

- Competitive hourly rate/salary

- Flexible work schedule

- Professional development opportunities

- [Other benefits your company offers]

Required For Application

- Resume

- 2-3 professional references

- Brief cover letter explaining relevant experience

- Sample monthly reconciliation process (if applicable)

To Apply

Please send your application to [email] with the subject line "Virtual Bookkeeper Application - [Your Name]"