From transaction management to audit, get it all here

Comprehensive Real Estate Bookkeeping Services

Transaction Management

Detailed tracking and recording of all property transactions, enhancing accuracy and accountability.

Tax Compliance and Strategy

Expert real estate tax accounting to optimize your tax benefits and ensure full compliance.

Financial Analysis and Reporting

Generate clear, actionable financial reports including cash flows, balance sheets, and income statements tailored to real estate needs.

Budgeting and Financial Forecasting

Strategic financial planning to support growth and investment decisions.

Rent Roll Management and Collections

Efficient handling of tenant accounts, ensuring timely collections and minimized vacancies.

Audit and Compliance

Rigorous preparation for financial audits and adherence to real estate regulations and standards.

Why Choose Real Estate Accountant from Wishup

Reliable Expertise for Every Transaction

Top 0.1% Talent

Only the most skilled and reliable Virtual Assistants make it through our rigorous selection process.

Vetted Experts

Wishup evaluates VAs on aptitude, skills, English proficiency, communication, personality traits and cultural fit.

Instant Onboarding

Our fast hiring process lets you onboard a candidate in just 60 minutes

Tax and Bookkeeping Solutions at Wishup

Start Your Tax Filing for Only $150

Our expert team handles your taxes with an eye for every possible deduction, helping you save more.

Dedicated Bookkeeping from $999

Hire remote bookkeeping experts for detailed transaction recording, financial reconciliations, and clear monthly financial statements.

Tax + Bookkeeping from $1,149

Our remote experts manage everything from keeping your books to filing your taxes, giving you peace of mind all year.

Simple 3-Step Process to Get Started

Talk to us about your specific real estate accounting needs.

Our clients say it better

Good Work leads to Good Words

Explore More Services

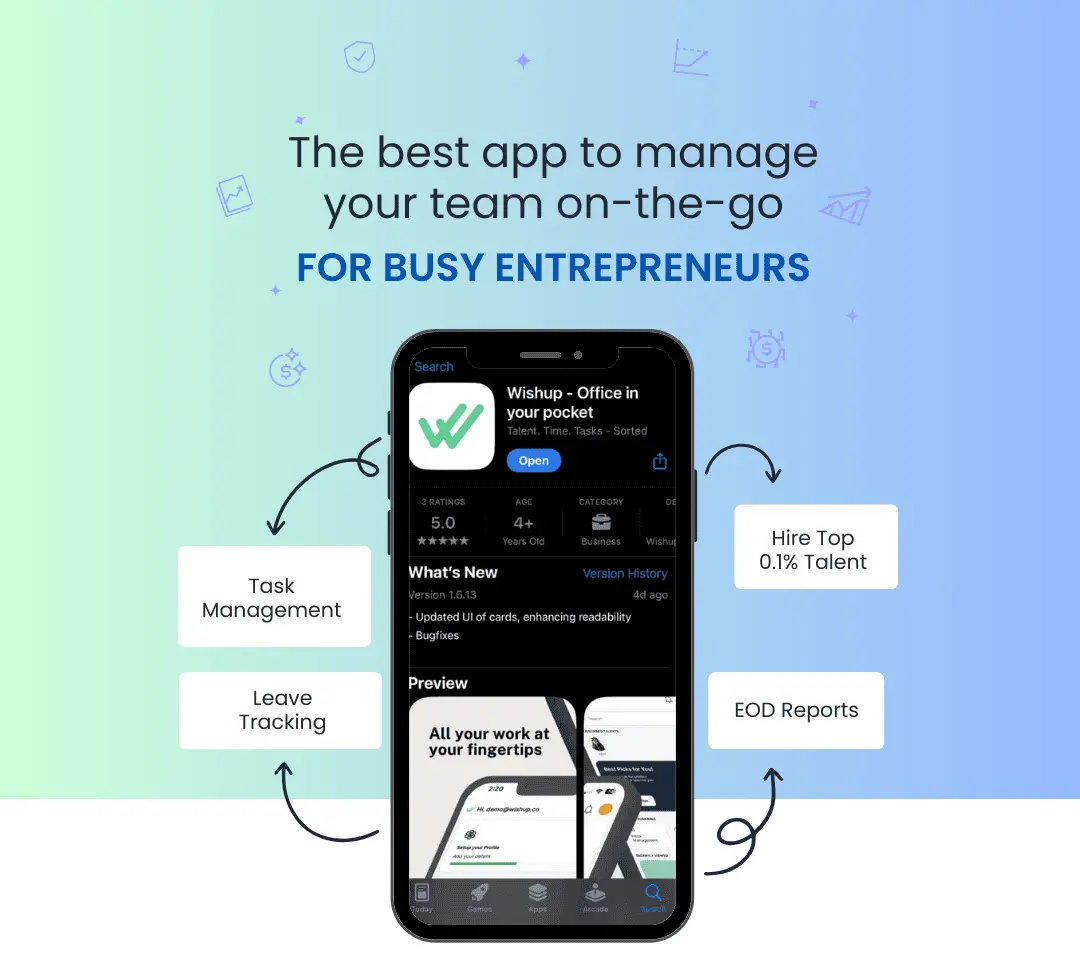

Manage Your Workforce Easily

Provide real-time feedback, manage projects, hire top-tier talent and get EOD reports—all from one app. Download the App Now!