Simplify Your Month End Close Process with These 10 Easy Steps

If you are one of those who worry about carrying out the close process, this guide is for you. You can first learn about the importance of the monthly closing. Then, we break down the entire closing process into 10 easy steps.

If you own a business, then specific work needs to be completed at the end of the month. The month end close process is one such critical activity. The closing process in accounting involves many things to do. Many business owners consider this to be a cumbersome activity. You need to do many things, and they would take a lot of time and effort.

If you are one of those who worry about carrying out the close process, this guide is for you. You can first learn about the importance of the monthly closing. Then, we break down the entire closing process into 10 easy steps. You can prepare a month-end close checklist based on the steps given. Follow this checklist, and the close process every month will no longer be troublesome.

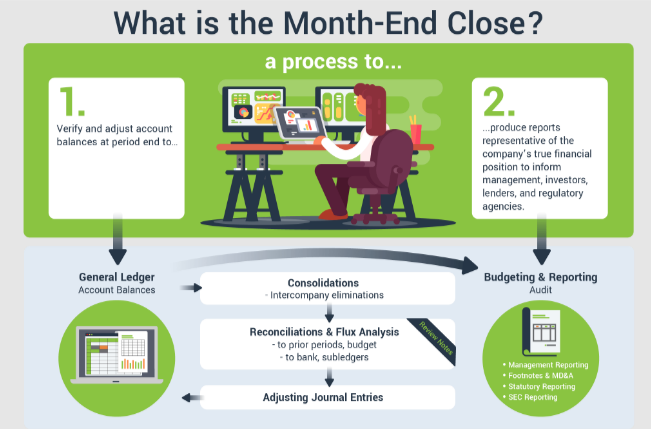

What is a Month-End Close Process?

The month-end close process is when all monthly financial accounts are closed. Closing includes collecting all necessary information related to the accounts and reviewing them. You need to reconcile all records. It involves checking all income and expenses and comparing them with records.

Depending on the business size, the closing process accounting could take up to 10 days. The people carrying out the closing need to check all transactions and journals. This process must get the importance it deserves. Completing the monthly closing on time ensures all data is ready for the year-end closing. To standardize your company's process, you can use an online flowchart creator to create flowcharts that visually document your month-end close process.

Why is the Month-End Close Process Important for Businesses?

Every business needs to prepare accurate financial reports on time. The reports are not merely a legal/regulatory requirement but crucial for the business. Financial statements help the business owner understand how the business is doing. You can make plans based on the reports. If a business has to prepare its annual reports on time, it must prioritize the monthly financial close process.

If the month-end closing happens seamlessly, it ensures all records are verified. The data needed for the reports would be ready and available by the end of the year. Most importantly, the closing process accounting would help in uncovering errors. The accountants can fix these errors so they are not carried forward.

In case you do not do this, it can have serious consequences. You must carry out the closing process for all the months at the year's end, which would be challenging and take a lot of time. As a result, the financial statement may be delayed. Another worrying scenario is that trying to finish the reports quickly could lead to errors. These errors can be costly as inaccurate financial statements negatively affect the business.

All the above clearly illustrates why it is vital to ensure you complete the month-end accruals QuickBooks process on time. The benefits of the month-end closing listed below clearly highlight its importance:

- It helps you keep your books of accounts and financial reports accurate.

- Your tax filing becomes easier if every month’s closing happens on time.

- It is very helpful to ensure trouble-free audits.

- You can detect errors and correct them to prevent future mistakes.

Month-End Closing Process Checklist: 10 Simple Steps

If you want your month-end closing to happen effectively, you need a month-end close checklist. The following is our checklist that explains how to carry out closing in 10 easy steps. Use this checklist to carry out your monthly closing without any hassles. It acts as a guide for all closing activities. You can learn how to close expense accounts along with other such details.

Record the Income and Expenses

You should record all income and expenses. The month-end close allows you to check this. You need to review if you have missed out on recording any cash that has come in. Check if you have included all sales revenue and incomes from investments, rentals, etc. You should check for the inclusion of payment of all bills, business travel expenses, supplier payments, and payroll. Check if the debit and credit entries are posted and review journal entries.

Review Accounts Receivable and Accounts Payable

Are your customers paying you as per agreed timelines? You can review this when you check the accounts receivable and accounts payable. You can generate the aged debtors report and then follow up with defaulters. Also, check accounts payable check for duplicate invoices and duplicate payments.

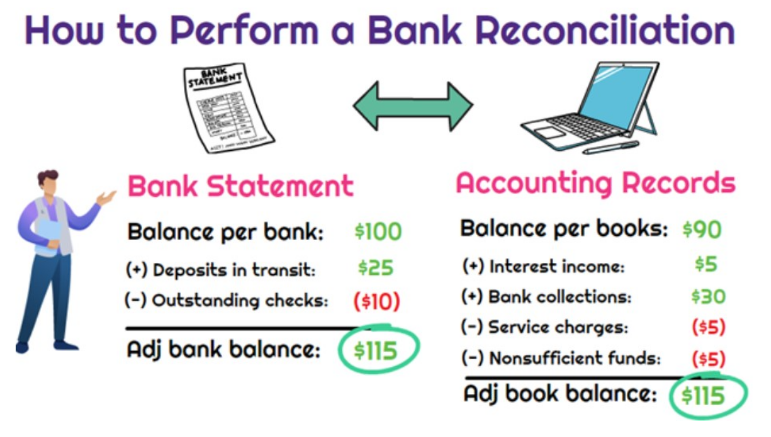

Prepare Bank Reconciliations

Bank reconciliation will help you identify any mistakes and also help you prevent fraud. You need to reconcile the checking and savings accounts. Check your card and loan accounts, as well as digital transfer payments. Check balances against your cash book. Look for any discrepancies and make adjustments accordingly. Maintain a bank reconciliation record.

Review Petty Cash

You need to check the funds available in petty cash at the start and end of the month. Reconcile all your deposits and receipts so that you can identify any discrepancies.

Review Inventory Count

An essential activity in the monthly closing is checking inventory levels. Update your inventory levels and review the management process. Take a hard look at how you order goods, when you reorder them, and prices paid. You also need to review your procedures for storing goods.

Review Fixed Assets

Fixed assets include buildings, vehicles, equipment, and intangible assets like your brand name. You need to review if all records of purchases and sales of fixed assets are updated. It is important to account for depreciation so you effectively allocate the cost of the assets over their lifetime. Also, review the condition of all your fixed assets. Record expenses related to maintenance and repairs.

Reconcile the Accrued and Prepaid Accounts

You must adjust the accrued and prepaid expense accounts to reflect all income and expenses. It is important to identify if any duplicate payments have been done. You can do this by double-checking prepaid and expense accounts. You must pay off accrued liabilities when due to avoid affecting your credit.

Prepare Financial Statements

You need to prepare three key financial statements:

- Income statement/Profit and loss.

- Balance sheet.

- Cash flow statement.

You can create these reports easily if you have accounting software. Further analysis depends on these statements, and hence it is crucial to ensure they are accurate. Remember that your financial statements will be accurate only if all the data is correct. Only when you complete the above steps can you generate the statements.

It is a good idea to get the statements reviewed by a CPA. The analysis they do will help you in your decision-making. Don’t forget to plan your tax to prevent penalties. You can work with a CPA or Wishup to complete your tax work promptly.

Review Your Financial Information

You need to review the general ledger and the financial statements to try and spot any errors. It is vital to do this before the end of the accounting period. In case any errors remain, you cannot create journal entries after closing the book. So, adjustment entries for any errors have to be done before you close.

Plan Ahead

Once you complete all the reviews, use the information obtained to plan for the future. Understand your success and failure areas. Focus on the key issues observed, like cash problems. Review if you are moving in the right direction and try to spot challenges you may face. Use the opportunity to review your business processes. It will help you decide if any process has to be changed.

How Wishup Can Help

Wishup offers online bookkeeping services for companies. Instead of hiring a full-time bookkeeper, using Wishup’s virtual bookkeepers is cost-effective. The experienced bookkeepers can help you with your financial close process every month.

Preparing Balance Sheets Or P&L Accounts

Wishup’s bookkeepers can help you complete your closing. Once they complete it, they can prepare your financial statements, including the balance sheet or profit and loss accounts. With their experience, you can expect accurate reports.

Reconciling Bank And Credit Card Statements

Reconciliation work takes much time. Leave this work to the virtual bookkeepers, who will do it scrupulously. They will reconcile all your bank and credit card statements helping you uncover any errors or mistakes.

Preparing General Ledgers

You can get your general ledgers prepared by Wishup’s virtual bookkeeping assistants. They are well-versed in all bookkeeping activities and can add value to your business.

Maintaining Financial Data

It is important to maintain financial data properly. Timely entry of data into your software ensures the monthly closing is trouble-free. When you hire a virtual bookkeeper, you can be assured that your financial data is in safe hands.

Entering Payables And Receivables

If you want payables and receivables to be entered, you can ask the virtual bookkeepers to do it. It will allow you to focus on your core work while the virtual bookkeepers handle it efficiently.

More benefits of outsourcing to Wishup

A question that you may have is why to outsource bookkeeping services to Wishup. There are multiple reasons why you should choose Wishup to hire virtual bookkeepers. The following are the benefits of hiring from Wishup:

- All the virtual assistant hired by Wishup are highly competent and experienced. Only the top 0.1% of applicants make it through Wishup’s hiring process.

- All virtual assistants undergo in-house training in more than 70 no-code tools they use for their work. They are also trained in more than 200 skill sets.

- Once you decide to work with Wishup, a dedicated account manager is named. The account manager is your single point of contact and can handle all your issues.

- Wishup’s virtual bookkeepers are ready to start work, and onboarding can be completed within 24 hours.

- A 7-day risk-free trial is Wishup’s way of convincing you of the quality of their virtual assistants. You can use their services for 7 days to understand their working methods. It is a great way to determine if their services meet your needs.

- Once the virtual assistant starts with the work, you can always ask for a replacement. If you are unhappy with their work for any reason, you will get an instant replacement.

- While choosing the virtual bookkeeper, you can choose either from the USA or from India. You can select the virtual bookkeeper who meets your specific needs.

How to hire from Wishup?

Working with Wishup is a great way to get your hiring needs fulfilled. Wishup follows a simple process to hire virtual assistants. The first thing you need to do is identify your problem area. Decide your requirements and determine what you want Wishup’s virtual bookkeepers to do. Once you finalize this, it is time to get in touch with Wishup.

You can schedule a free consultation with Wishup to inform them of your requirements. They would then identify a virtual assistant to handle your company’s month-end close process. Onboard your virtual assistant and get started with the work. You can relax and focus on your core work while Wishup’s virtual bookkeeper will handle the monthly closing.

Conclusion

The financial close process at the end of every month helps businesses to keep their accounts up-to-date. It ensures that their data is accurate and can be relied on to prepare annual reports. The 10-step process explained in our guide will help you create an accounting month-end close checklist. With this checklist, carrying out the monthly closing process will be easy.

To make your closing process trouble-free, consider using Wishup’s virtual assistant services. Hire virtual assistants and use their help for a seamless financial closing every month. You can schedule a free consultation with Wishup to discuss how to do this. You can also send an email with your requirements to [email protected] so that we can contact you as soon as possible.