How to Pay Your Virtual Assistant: 5 Popular Platforms

In 2025, there are plenty of payment platforms to choose from. To help you make the right choice for your business and virtual assistant, we've compiled a list of the top 5 payment platforms to help you pay quickly and safely.

As the world becomes more internet-dependent, businesses rely on virtual assistants to help manage their workload. But how do you ensure the VAs get paid accurately and on time when it comes to remote work?

In 2025, there are plenty of payment platforms to choose from. To help you make the right choice for your business and virtual assistant, we've compiled a list of the top 5 payment platforms to help you pay quickly and safely. So, whether you have just hired a new virtual assistant or are looking for a better way to pay for your current one, this blog post is for you.

So, let's walk you through the best ways to pay virtual assistants in 2025 and beyond. Read on!

Things to Consider While Paying a Virtual Assistant

When it comes to paying a virtual assistant, you must consider certain key points. Let's discuss some of the key points to remember when it comes to paying your VA:

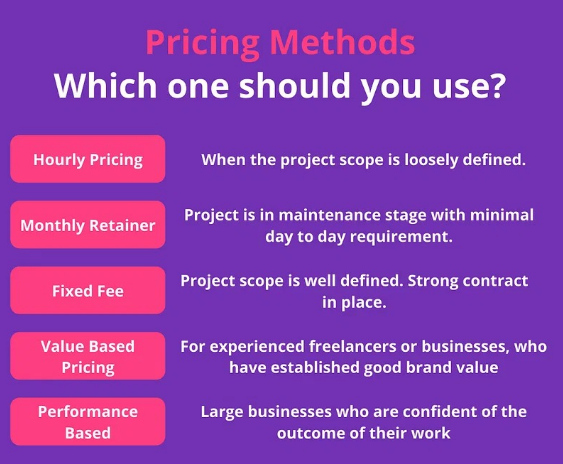

Hourly vs. Project-Based Pay: Which is Right for You?

When deciding how to pay your virtual assistant, deciding whether to use an hourly or project-based payment structure is crucial.

Hourly payment models can be great for tasks requiring different amounts of time and effort. On the other hand, project-based pay can be ideal for tasks with a definite finish line and can be done in a set period.

Currency Exchange Rates and Conversion Fees

When working with a virtual assistant from an overseas location, it's important to think about currency exchange rates and conversion costs. Choose a payment platform that has competitive exchange rates and low fees.

Payment Frequency: Weekly, Biweekly, Monthly, or as Agreed?

Payment frequency is a major factor to consider when deciding virtual assistant payment setup and plan.

Most platforms offer the standard weekly, biweekly, and monthly payment options. However, some let you arrange payments according to milestones (like after finishing a task or project). Choose whatever suits you and your VA the best and is available on the platform you are using.

Taxes and Withholding: Who is Responsible for What?

Before bringing in a virtual assistant, knowing who is responsible for taxes and withholding is important. Generally, the virtual assistant is seen as an independent contractor, meaning they take care of the taxes themselves. Still, it's smart to confirm this with your virtual assistant and agree on who'll handle tax and withholding matters.

Invoicing and Record-Keeping: Best Practices for Both Parties

It's important to keep accurate records and invoices for both parties. Virtual assistants should make sure their invoices are precise, including the number of hours worked, the pay rate, and when the payment is due. As a client, keeping your records organized and making sure you pay on time is a must.

Late Payments and Payment Disputes: How to Avoid and Resolve Them

No one likes dealing with late payments and payment disputes, and they can strain business relationships. To prevent this, make sure you set out your payment terms and policies right away. If a payment dispute arises, it's important to communicate quickly to try and reach a resolution.

Communication: Setting Expectations and Maintaining Transparency

When it comes to virtual assistant payment methods, good communication is the key. Establishing expectations from the start – like payment terms, frequency, and other details – can help build a strong relationship. Plus, it will ensure everyone's on the same page and that payments are made promptly and accurately.

How to Pay a Virtual Assistant: 5 Best Payment Platforms

Here are the top five payment platforms for VAs, as well as how to use them.

PayPal

Paying for virtual assistants through PayPal is one of the best ways to pay virtual assistants. It's a widely recognized payment platform accepted by almost all businesses globally, making it a great option for paying virtual assistants.

Are you wondering - how to pay virtual assistant through PayPal? Or what do virtual assistant and PayPal payments involve? Whatever the case, we have all the answers for you below!

How to create a PayPal account:

Step 1: Head to Paypal and hit the "Sign Up" button.

Step 2: Pick whether you want a personal or business account.

Step 3: Put in your personal info and banking details.

Step 4: Confirm your email and link your credit card or your primary bank account to your PayPal account. And you are all set!

Adding funds to your PayPal account:

To put money in your PayPal, just log in and hit the "Add Money" button. Pick your funding source and enter the amount you want to add. Then, confirm the transaction and you're good to go!

How to send money to your virtual assistant using PayPal:

To send money to your virtual assistant using your PayPal account, log in and click on the "Send & Request" button.

Next, enter the VA's email address or phone number, followed by the amount and currency. Finally, click "Send" and confirm the transaction to complete the process.

While PayPal offers a smooth money transfer experience, sometimes you might encounter certain issues. For example, if you face issues like - PayPal holding money for 90 days virtual assistant, make sure to connect with the support team!

Wise [Old name - TransferWise]

Using Wise to pay your virtual assistant is another excellent choice. Wise is an easy-to-use platform with low fees and great exchange rates so you can make international payments with no hassle. Simply, set up your Wise Account, and you're good to go!

How to create a Wise account:

Step 1: Open Wise on your computer or download the app, hit the "Register" button

Step 2: Enter your details - name and email address.

Step 3: Verify your email and finish setting up your account by filling in your address and phone number.

Step 4: Don't forget to include a copy of your ID for verification!

How to add funds to your Wise account:

To add funds to your Wise account, go to the "Balances" tab. Pick the currency you want to add funds to, then hit the "Add" button and choose the payment method.

Finally, enter the amount you'd like to add, and confirm the transaction.

How to send money to your virtual assistant using Wise:

To send money through your Wise account, just log in and click the "Send Money" button. Then, input your virtual assistant's email address or bank details.

Now, enter the amount and currency you want to send. Once you're satisfied with the transaction details, hit the "Send" button, and it's done!

Payoneer

Payoneer is a great online payment platform that simplifies money transfer to India, online payments, and other cross-border transactions.. It's been around since 2005 and is based in New York. It's user-friendly and has low transaction fees.

How to create a Payoneer account:

Step 1: Visit Payoneer's website and click on the "Sign Up" button. Select the type of account.

Step 2: Enter your personal and business information into the appropriate fields.

Step 3: Verify your email address and identity.

Step 4: As soon as the account has been approved, you start linking your bank account or debit card to your Payoneer account.

How to add funds to your Payoneer account:

To get your payment, log into your Payoneer account, click "Receive", and choose the best option for you. Then just follow the instructions to get it all set up.

How to send money to your virtual assistant using Payoneer:

Log into your Payoneer account and click on "Pay". Then, choose "Make a Payment" and enter your virtual assistant's email address with the payment details. Double-check the payment information before you hit "Send".

Skrill

Skrill is a great option for individuals and businesses who work with international clients. It is a UK-based provider of digital wallets. It was established in 2001 and is now owned by the Paysafe Group. A fantastic thing about Skrill is its low fees and quick transactions!

How to create a Skrill account:

Step 1: Visit the Skrill website and hit the "Get Started" button.

Step 2: Enter your personal and contact info as requested.

Step 3: Then, go ahead and verify your email address and identity with the help of a passport or driver's license.

Step 4: You can link your primary bank account or cards to your Skrill profile when your account gets approved.

How to add funds to your Skrill account:

To add money to your Skrill account, log in and click "Deposit". After that, choose an option that suits you best and follow the instructions.

How to send money to your virtual assistant using Skrill:

Click on "Send Money" and fill in your virtual assistant's email address. Then, enter the payment details like the amount, currency, and country. Press the "Send" option.

Hire Wishup and Make Payment Easy

Are you in search of a VA for your business? Look no further than Wishup! We make getting started with a VA easy and secure - no hassle. We also make it incredibly easy for you to make payments to your VA.

With us, you won't have to worry about things like - "how to share credit card info with virtual assistant", "how to give my virtual assistant credit card details to use," etc.

Here are some benefits of hiring Wishup virtual assistants:

Strict Hiring Standards

At Wishup, we get it - finding the perfect virtual assistant can be tough. That's why we've established rigorous hiring criteria to guarantee our customers are working with the cream of the crop. Our recruitment process is designed to spot the top 0.1% of applicants who are college graduates with relevant experience.

Highly-skilled Experts

Our virtual assistants have more than 200 different skills and proficiency in 70+ no-code tools. So, they can adapt to whatever your business needs.

Thoroughly Screened and In-House Trained

At Wishup, we're dedicated to providing top-notch services to our clients. We ensure all of our virtual assistants go through a rigorous screening process. We also provide them with in-house training in the latest tools and trends. That way, we can guarantee our clients the best experience possible!

No-Questions-Asked Instant Replacement Policy

If you decide a virtual assistant isn't the right fit for your business, we've got you covered. Our no-questions-asked instant replacement policy. So, if your primary VA is unavailable, or you're unhappy with their services, you can get an instant replacement at no extra cost.

Onboarding Within 60 Minutes of Selection

You can get your new virtual assistant up and running in no time with Wishup! At Wishup, we guarantee onboarding within 60 minutes of selection, so you can start collaborating with your assistant immediately.

US and India-based VAs

Depending on your needs, Wishup can give you access to virtual assistants both in the US and abroad! So, you can find your desired VA and start working with them without any hassle.

Contracts, Insurance, Liabilities, or Employee Benefits are Taken Care Of

As our client, you won't have to worry about contracts, insurance, liabilities, or employee benefits - Wishup's got it covered! From the tool for credit cards for virtual assistants to any training materials, we take care of everything for you.

Privacy and Data Security Assurance

At Wishup, we know how important it is to keep your data safe. That's why we use NDAs (Non-Disclosure Agreements) to protect your sensitive information when you work with a virtual assistant from us.

How to hire from Wishup?

The hiring process of Wishup includes the following:

Step 1: Identify your problem area

Before you dive into the process of hiring a virtual assistant, take some time to identify the areas your business needs help in. Figure out which tasks you're looking to delegate to a virtual assistant and create a job description that outlines the role you have in mind.

Step 2: Schedule a free consultation

Once you've figured out what help you need, you can look for virtual assistant. Many of them provide free consultations to discuss your needs and determine which virtual assistant is best for you.

Step 3: Onboard your virtual assistant

Once you've chosen a virtual assistant, it's time to get them onboarded! This means filling them in on all your company's processes and procedures, giving them access to relevant systems, and giving them clear directions for each task. You can also pick a virtual credit card for a virtual assistant and tell your assistant about virtual assistant credit card handling.

Conclusion

So that was all about the best ways to pay virtual assistants!

Overall, selecting the correct payment method is essential to ensure invoices and their respective payments are received on time and correctly. As discussed in this blog, all five payment platforms have their advantages. So, you must consider your specific requirements and preferences when deciding which is best for you.

Are you interested in learning how to set your rate as a virtual assistant? Or how to handle rate charges for more than 2 clients as a virtual assistant, and where does the virtual assistant collect payment? If yes, read our other blogs!

If you need a VA, don't hesitate to contact Wishup. To learn more about how Wishup can help simplify your payment process, schedule a consultation or email [email protected].