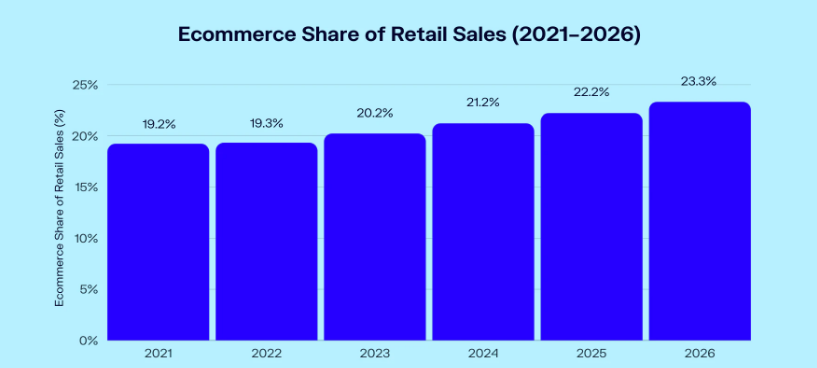

Studies anticipate worldwide eCommerce sales to reach $6.54 trillion in 2024, showcasing 22.9% of total retail sales and how eCommerce is becoming important in the global economy.

However, owning an eCommerce business won't guarantee success solely as the industry is competitive.

To get through this competition, you must also pay attention to your eCommerce bookkeeping.

The unique aspects of eCommerce bookkeeping compared to traditional bookkeeping make it essential for online business owners looking for eCommerce bookkeeping services.

With complex sales tax rules and multiple payment gateways, losing track of your finances is easy.

Hence, knowing the status of your weekly, monthly, and annual income and expenses with bookkeeping gives you a clear picture of your eCommerce business.

Thus, hiring a virtual bookkeeper becomes a necessity for online business owners like you. It helps keep track of inventory and cost of goods sold and handles sales tax and profits and a lot more. On top of that, collaborating with an Amazon PPC agency can enhance your marketing strategy, ensuring you allocate the right budget to drive sales without affecting your bottom line.

All of it adds up to give you exact figures and reports for your business without any hassle during tax season.

What is eCommerce Bookkeeping?

Bookkeeping involves keeping track of the money that enters and leaves your company. It includes organizing, sorting, and recording the financial transactions of a business.

Online Bookkeeping Service for eCommerce is similar to retail bookkeeping. The difference is that it accommodates the requirements of a business operating online.

eCommerce businesses can record financial data digitally. They can combine it with accounting software.

Detailed Overview of The Fundamentals of eCommerce bookkeeping

A business owner needs to consider many elements when managing eCommerce bookkeeping. This includes considering the methods to track details like financial transactions. Business owners will need receipts, invoices, and templates for the different sales channels.

Business owners must understand the financial statements used in eCommerce businesses. This will help them have a clear knowledge of the business financials and raise profits.

Cash flow statement

This is the most crucial piece of information for bookkeeping for online business. The cash flow statement contains the details of every penny a business spends. It includes information about the rent, inventory, and income stream. It has details about maintenance and taxes.

Cash flow will give business owners an idea about their revenue and profit. This statement is important for online retailers. They will know where their money is going. This will help them to maintain a good profit margin.

Read more about cash flow management here.

Income statement

An income statement contains money a business brings during a specific time. This can be a month, a quarter, or a year. The statement will show both non-operating and operating income. The money you get through routine business activities is the operating income.

In an eCommerce retail business, this comes from your inventory sales. The money you earn through activities unrelated to your business is the non-operating income. An example is the returns from a stock or real estate investment.

One crucial part of managing finances, especially for those looking to diversify with real estate investments, is understanding how to secure a mortgage. Gaining insights into this process can offer better financial management and asset-tracking strategies.

The income you get by selling old equipment or warehouse is non-operating income.

Balance sheet

The balance sheet of a business records its liabilities and assets. It also contains the owner's equity. This statement has two columns. One column lists the business's holdings, and the other lists the liabilities.

The assets of your eCommerce business include equipment, inventory, and cash funds. The liabilities include outstanding mortgage payments or business loans.

Risk Management

In eCommerce bookkeeping, risk management involves recognizing and mitigating potential economic risks that could impact the business. This includes assessing risks related to fraud, payment processing, cybersecurity, and market fluctuations. Effective risk management strategies help protect the financial integrity of the eCommerce business and ensure its long-term sustainability.

Revenue Recognition

Revenue recognition refers to accurately recording and reporting revenue earned from sales transactions. In eCommerce bookkeeping, revenue recognition is crucial for determining the business's financial performance. This involves recognizing revenue when earned, regardless of when the payment is received, and adhering to accounting standards such as recognizing revenue at the point of sale or upon delivery of goods or services.

Sales Reporting

Sales reporting involves tracking and analyzing sales data to gain insights into the eCommerce business's performance. In eCommerce bookkeeping, sales reporting includes generating reports that provide detailed information about sales trends, customer behavior, product performance, and revenue generated from different sales channels. Sales reports help business owners make informed decisions regarding marketing strategies, inventory management, and pricing.

Financial Reporting

Financial reporting encompasses preparing and presenting financial statements that summarize the financial performance and position of the eCommerce business.

In eCommerce, bookkeeping plays a significant role in creating financial reports such as cash flow statements, income statements, and balance sheets. These reports are vital in providing stakeholders with an accurate and transparent representation of the company's financial health. Prudent financial reporting is necessary to comply with regulatory requirements and build trust with investors, creditors, and other stakeholders.

Tax Compliance

Tax compliance in eCommerce bookkeeping involves adhering to tax laws and regulations applicable to online businesses. This includes collecting and remitting sales tax, filing tax returns accurately and timely, and complying with other tax obligations such as income tax, VAT (Value Added Tax), and customs duties. Proper tax compliance helps eCommerce businesses avoid penalties, audits, and legal issues while optimizing their tax liabilities.

Inventory Management

Managing inventory involves acquiring, storing, and monitoring inventory to maintain sufficient stock levels while reducing expenses and increasing profits.

Good inventory management practices include:

- Real-time tracking of inventory levels.

- Optimizing reorder points.

- Implementing inventory valuation methods.

- Managing stock turnover rates.

Proper inventory management is essential for fulfilling customer orders promptly, minimizing stockouts, and reducing excess inventory holding costs.

Expense Recording

Expense recording involves accurately documenting and categorizing all expenses incurred by the eCommerce business. In eCommerce bookkeeping, expenses may include product procurement, marketing, shipping, fulfillment, technology infrastructure, and overhead costs such as rent and utilities.

Tracking and analyzing expenses help business owners identify cost-saving opportunities, optimize spending, and improve overall financial performance. Proper expense recording also facilitates eCommerce business's budgeting, forecasting, and decision-making processes.

Since proper expense recording is crucial for budgeting and decision-making in eCommerce businesses, it parallels the essential processes required to file a US tax return. Understanding these foundational bookkeeping steps ensures accuracy and compliance in financial reports, which can ease the daunting task of tax filing complexities US expats face.

Why is eCommerce bookkeeping necessary?

eCommerce bookkeeping is important for an online business owner. To succeed, the total expenditures for an online business should not exceed overall sales.

Business owners can make their businesses profitable by knowing the basics of eCommerce business accounting. Every online business should have an efficient bookkeeping system in place.

Some ways in which eCommerce bookkeeping can help are:

Maintaining records

eCommerce sales will reach 23% of global retail sales by 2027. Studies show that 79% of eCommerce clients purchase at least once a month.

So, eCommerce businesses may experience multiple transactions every day. Recording every sale or transaction is important. This will help you understand the overall profit of the business.

eCommerce bookkeeping will help you to record and store those transactions.

Handling your finances

Making sound financial choices is important for running an eCommerce business. Business owners should have a good knowledge of the cash flow in their business. This will help them to avoid overspending.

eCommerce bookkeeping will help owners to create a proper record of all their transactions. They can manage the business finances.

It gives you better tracking of your inventory

eCommerce businesses should know their inventory levels at all times. This will allow them to manage their stocks.

Without correct records, businesses run the risk of ending up with too much or too little inventory levels. This can be bad for business.

eCommerce bookkeeping services can help business owners track their inventory levels.

Helps in easy decision making

Trusting your instincts is important in business. Having access to accurate financial information is even more important.

eCommerce bookkeeping helps businesses to track their finances. It allows them to manage their inventory. This will allow them to make informed choices.

Helps in understanding profitability

Product profitability or SKU profitability depends on many variables. This includes the price of a specific SKU, advertisement, and staffing costs, and conversion rates.

eCommerce bookkeeping helps business owners to track variables affecting SKU profitability.

Tasks that an eCommerce Bookkeeper can achieve

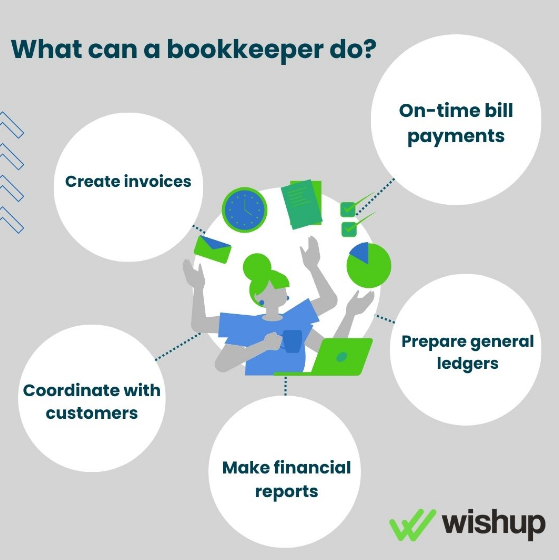

The eCommerce business is different from the traditional retail business. An eCommerce bookkeeper can help businesses do many financial and business tasks.

An eCommerce bookkeeper is familiar with online business activities. This includes sending invoices, reviewing budgets, and submitting financial reports.

They can help business owners with other tasks essential for running a business.

Keeping track of sales

An eCommerce bookkeeper can help a business keep track of sales. They can record the number of sales daily.

They can prepare sales reports to understand product profitability.

Handling your finances

An eCommerce bookkeeper can handle all the financial tasks of an online business. This includes managing payroll and bank statements, sending invoices, and reviewing budgets.

A business owner can focus on expanding the business and closing deals. Bookkeepers will reduce their work by managing their finances.

Assisting with sales tax-related issues

Many eCommerce business owners face difficulties with paying sales tax. An eCommerce bookkeeper can make accurate tax calculations and file tax returns on time for them.

Managing inventory

An eCommerce bookkeeper can keep track of products in the inventory. They can also inform the managers when stock levels are low.

This will help eCommerce businesses maintain good stock levels at all times.

Taking care of loan details

Many eCommerce business owners find it difficult to calculate their outstanding loan payments.

A skilled eCommerce bookkeeper can help them keep track of loan payments. They can help them calculate the payment amount.

Where can you hire eCommerce Bookkeepers?

You can hire eCommerce bookkeepers as in-house employees or from freelance platforms.

Virtual Bookkeeping Agencies

Platforms like Wishup provide access to a pool of highly skilled bookkeepers with expertise in eCommerce bookkeeping. They can handle all aspects of bookkeeping, including financial statements, bank reconciliations, and inventory management.

One of the main advantages of hiring a virtual bookkeeper from virtual assistance agencies is that they are often more cost-effective than hiring in-house employees. You only pay for the services you need, and you can scale up or down as your business needs change.

Virtual assistance agencies also provide a level of flexibility that in-house bookkeepers cannot match. You can communicate with your bookkeeper via email, phone, or video conference, making collaborating easier and getting the support you need.

In addition, virtual assistance agencies typically have established processes and procedures in place, making it easy to get started and ensuring that your bookkeeping is up-to-date and accurate.

Freelancer Platforms

You can also hire eCommerce bookkeepers from several freelance platforms. There are several dedicated bookkeeping service providers as well.

You can use them to hire a bookkeeper to suit your business needs and budgets. They will be well-trained in different tools used for bookkeeping. So, you do not have to spend money on training them.

Is hiring an eCommerce bookkeeper a good idea?

eCommerce business owners can face several issues while running their businesses.

Many business owners may not be familiar with the financial business aspects. They may not know about the tools needed for bookkeeping.

An eCommerce bookkeeper is someone with experience in the industry. They are familiar with the different processes and tools used in bookkeeping.

They can also prepare financial statements and reports easily.

An eCommerce bookkeeper will be able to free up a lot of time for managers. This will allow them to focus on tasks related to business growth.

Common mistakes in e-commerce bookkeeping

Here are some common mistakes in e-commerce bookkeeping.

1. Not Tracking All Expenses

Every little cost matters. If you forget to write down even small expenses, you might lose track of where your money is going. Over time, this adds up!

2. Mixing Business and Personal Money

Imagine using your piggy bank for both your toys and business things. It gets confusing! Keeping business money separate from personal money makes it easier to see what your business earns and spends.

3. Forgetting About Fees

Platforms like Amazon and eBay charge fees to sell on their sites. If you forget to record these fees, your earnings will look higher than they are. Always note down these extra charges. Using Amazon PPC management tools can also help track advertising costs more accurately alongside platform fees.

4. Not Recording Sales Tax Correctly

Sales tax is an extra amount added to some items when you sell them. You might pay more tax than needed if you forget to track this correctly.

5. Ignoring Inventory Costs

When you buy stock (inventory) to sell, it costs money. If you don’t record these costs, your profits will look higher than they are. Keeping track of what you paid for your stock is very important.

6. Not Recording Refunds

Sometimes, customers return items, and you give them their money back. If you forget to record these refunds, it will look like your business made more money than it did.

7. Missing Out on Monthly Check-Ins

Bookkeeping isn’t just a once-a-year thing. Mistakes pile up if you don’t review your books each month, making it harder to fix things later. Checking monthly keeps everything organized.

8. Ignoring Bank Reconciliation

This means matching up your records with your bank account. If you don’t do this, you might miss errors or fraud. It’s like making sure your piggy bank and allowance match up!

9. Overlooking Sales Channels Differences

Selling on different platforms (like Amazon, eBay, Walmart, or Etsy) means each one might have unique fees or rules. Forgetting these differences can mess up your records.

Keeping your books in order helps you see how much your business earns and spends—just like a CFO would say!

Why hire from Wishup?

Wishup is a top virtual assistant outsourcing agency. We at Wishup are committed to offering our clients the best bookkeeping services.

Our bookkeepers are skilled, experienced, and professional. We help our clients connect with a professional best suited for their business activities.

With Wishup, you get these perks:

- Reasonable services

- Easy 30-minute hiring

- Pre-vetted and trained professionals

- Confidentiality

- Instant replacement

- 3-Day trial with a money-back guarantee

Conclusion

Bookkeeping is essential for any business in the eCommerce industry. It helps business owners keep track of their spending and revenue. It helps them make better financial decisions.

An eCommerce bookkeeper can help owners handle bookkeeping tasks. This will allow them to focus more on closing deals and expanding business.

Wishup offers top eCommerce bookkeeping services for business owners. Our skilled bookkeepers can help you with all business activities. For hiring a top-notch virtual bookkeeper, schedule a free consultation with Wishup today. You can also email us at [email protected]

eCommerce Bookkeeping Frequently Asked Questions

What is eCommerce bookkeeping?

eCommerce bookkeeping is a process involving several eCommerce business tasks. It mainly focuses on cash flow and inventory. It is similar to traditional bookkeeping.

How do you do eCommerce accounting?

eCommerce accounting compiles, organizes, analyzes, and reports a company's financial data. It includes carrying out many accounting duties for an eCommerce business.

eCommerce accounting needs eCommerce bookkeeping to function successfully.

Why is bookkeeping important for eCommerce?

Bookkeeping is a vital part of the eCommerce business. It keeps track of inventory levels, manages financial transactions, and makes reports.

Bookkeeping helps business owners understand the financial situation of the company. This will help them make better financial choices. This, in turn, will help the business grow.